Company Car Tax Changes 2025 New Jersey. Sales tax changes given the growing popularity of electric vehicles, or evs, murphy called for phasing out what is now a 100% exemption from the state’s 6.625% sales tax, first enacted in 2003. Phasing out deductions for combustion engine cars;

The car fuel benefit multiplier will rise to £28,200 (currently £27,800). Each of these changes to maximum benefit rates and taxable wage base will take effect on january 1, 2025.

Doublecab pickup truck tax explained 2025 company car tax changes, As it stands, a double cab pickup truck with a carrying capacity of one tonne or more is classed as a light commercial.

Company car tax changes sees uptake of electric vehicles Powersystems, As we enter in a new year, 2025 brings a new set of tax changes for company cars.

Doublecab pickup truck tax explained 2025 company car tax changes, The car fuel benefit multiplier will rise to £28,200 (currently £27,800).

Doublecab pickup truck tax explained 2025 company car tax changes, As we enter in a new year, 2025 brings a new set of tax changes for company cars.

New Car Tax Rates 2025 Jaine Phylis, From there, the same tax law calls for the state’s full sales tax of.

New Car Tax Rates 2025/2025 Ivett Letisha, Each of these changes to maximum benefit rates and taxable wage base will take effect on january 1, 2025.

Hmrc Tax Allowances 2025 2025 Image to u, The following new rates will come into effect from 6 april 2025:

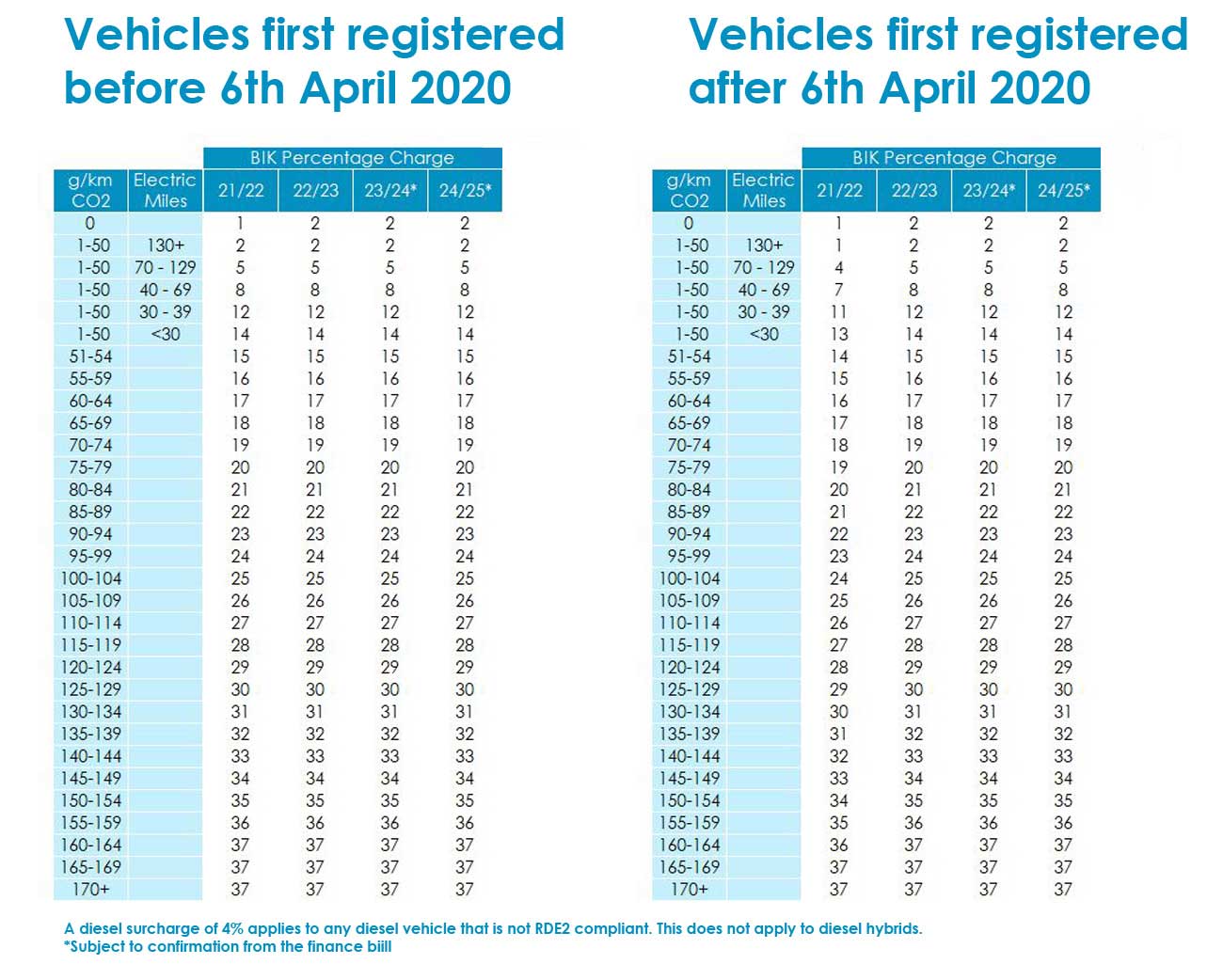

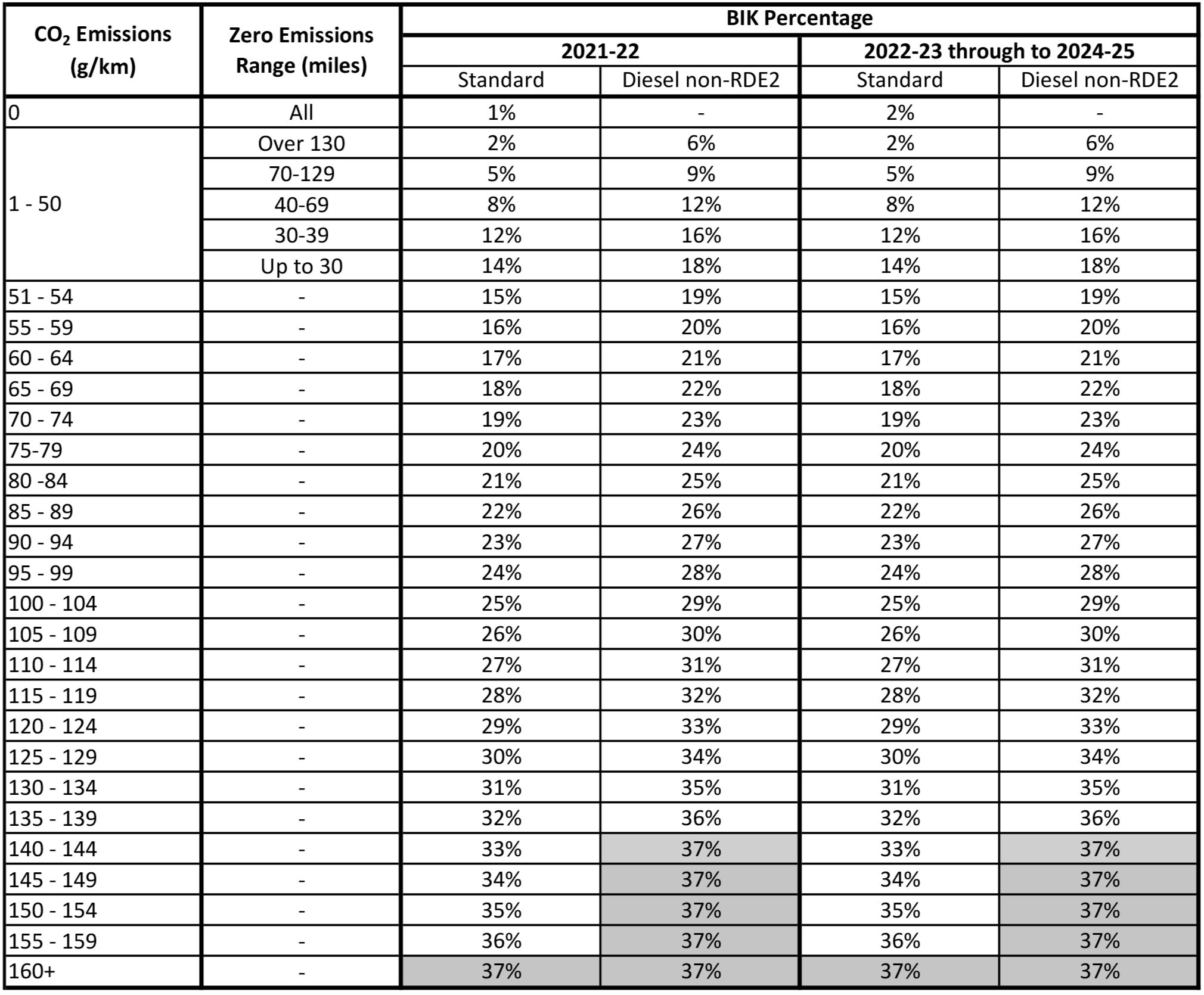

New Car Tax Bands Uk 2025 Joni Bobbette, Changes to company car tax will come into force from 6 april 2025, 2026, and 2027, respectively, and are due if an employer provides an employee with a company car that.

Kyle Robertson on LinkedIn 🚙 Company Car Tax Changes 🚙 With the, 1 through june 30, 2025, a 3.3125% tax will be levied in new jersey on such transactions.